The Architects’ Council of Europe (ACE) has completed a sector study, showing a comprehensive picture of the profession and the architectural market. By interviewing more than thirty thousand architects across twenty six European countries, the study offers statistical insights into the dynamic field of building design.

Architects in Europe

There are 620 000 architects in Europe, equating to one architect for every 1000 people in Europe. The number of practices have increased by 20% this year, compensating for the fall recorded in 2020. The profession has recovered after the pandemic — the unemployment rate stands at 2%, which is one of the lowest rates ever recorded. Architects have returned to full-time work, with full-time employment at the highest level recorded. Comparing with the average in Europe, Latvia has the highest rate of architects working part-time — one quarter.

The proportion of women in the profession has increased significantly in the last ten years. In 2012, 36% of architects were female, now this has increased to 46%, while female architects are the majority in Latvia (54%). The gender pay gap still exists, but is becoming smaller ― this year’s pay gap is 17%, which, although considerable, is almost half of what it was ten years ago.

The proportion of architects who describe themselves as sole principals or partners and directors, has been rising steadily over the last decade. Correspondingly, fewer architects are employed are salaried architects in private practices, having fallen to 18%. In Latvia, almost 60% of architects are sole principals, partners, or associates, with only 19% being salaried employees, 9% working as freelancers and 10% working for the public sector.

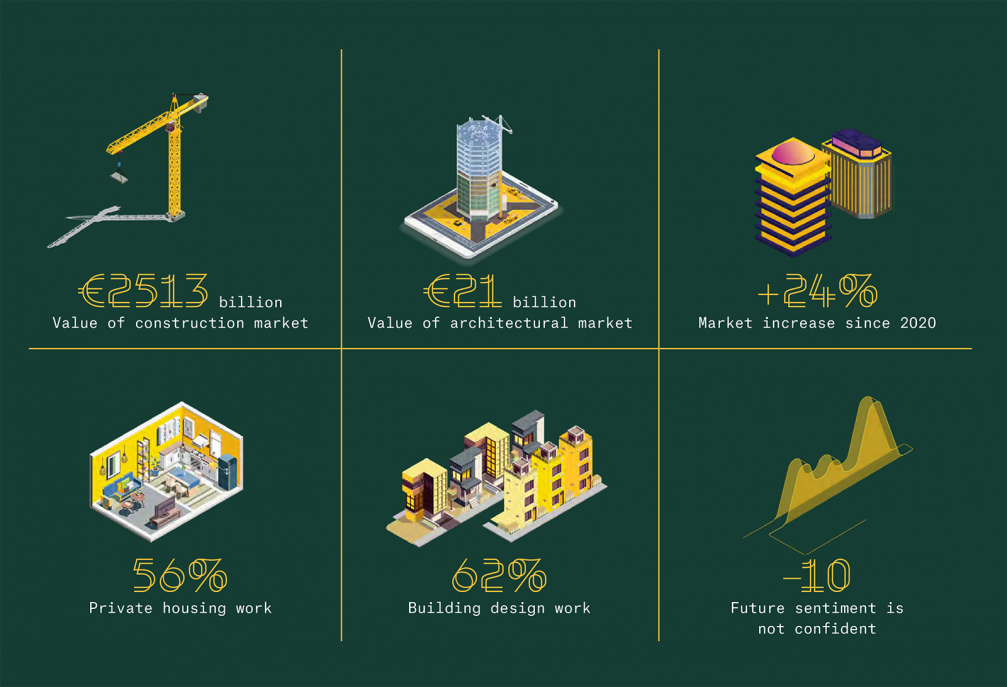

Architecture ― the market

The pandemic caused construction output to fall back, but before then output has been rising steadily almost every year, regardless of the economic cycle. This upward trend resumed in 2022, although the most recent figures from Eurostat suggest growth may be tailing off as economic conditions worsen. For example, Latvia has been one of the few countries experiencing falling construction outputs, with the construction market decreasing by 5% since last year.

Architects’ sentiment about their future prospects has improved since the last survey, but remains negative, with more architects expecting their workload to fall than to rise in the next 12 months. Latvian architects express a comparatively high optimism, with 44% of the respondents predicting a growing workload in the coming year.

The architectural market is heavily dependent on one sector. More than half of the market comes from private housing. Two thirds of the market value of private housing revenue is architectural work for new individual houses, house extensions or loft extensions. Overall, 89% of architectural practices are involved at least to some extent in private housing work. While heritage work makes up 14% of the European market, Latvia has the third highest market share of heritage work, standing at 28%.

Architecture ― the practice

The number of practices in Europe has increased this year, to an estimated 150 000. This more than compensates for the fall recorded in 2020. Then, it was speculated that architects in one or two person practices were moving to work in larger practices. This year, as a result of the pandemic, larger practices are likely to have shed staff so these architects may have set up on their own or in partnership with one or two others. This may explain why the total number of practices has grown. The largest growth has been in the number of small practices, with one or two staff. 81% of architectural practices in Latvia are estimated to have only one or two architects.

There is a wide range of methods of calculating how much to charge for services offered. This year’s survey shows the most popular method, used by 35% of architects, is to charge on the basis of a percentage of the job’s contract value. This method is used for a majority of jobs in seven countries, including Latvia. Slightly fewer architects calculate charges as a lump sum, and only 15% make the calculation based on an hourly charge.

16% of practices entered an architectural design competition in the last 12 months, higher than in 2018 and 2020. But practices made fewer bids for OJEU projects (tenders published from the Official Journal of the European Union), averaging only 0.5 bids per practice. The most frequently cited reasons for not making OJEU bids were because the process was too onerous, too costly, or the timetable too tight.

Amongst practices who entered an architectural design competition, success rates achieved have improved on previous years. However, the higher success rates have come at a cost of needing to spend many more hours preparing entries than previously, with a greater financial burden on practices. But rewards are correspondingly higher, too; the average fee received for successful competition entries and the average prize money received are both higher than in any of the previous surveys.

Architect ― the individual

Half of architects say they use 3D modelling tools frequently and a quarter use BIM tools, showing that architecture is an increasingly digital profession. Consequently, architects are developing their knowledge to enhance their competences and embrace environmental sustainability, with nearly half of architects using sustainable concepts frequently to design low energy buildings. In most countries the proportion of architects using sustainable concepts is close to this Europe average, although in Latvia the proportion is closer to one fifth.

The ACE carries out a sector study every two years. A full report can be found here, while the online tool ACE Observatory offers an easy way to engage with the large amount of data from this and previous ACE sector studies.

Viedokļi